Have you ever wanted to make big purchases without feeling the financial pinch? NIC ASIA Instabuy is designed to simplify your financial management. This service enables NIC ASIA credit cardholders to convert large expenses into convenient, manageable monthly EMIs, allowing you to enjoy your purchases without the burden of one-time payments.

With NIC ASIA Instabuy, you can upgrade your lifestyle or handle sudden financial needs with ease. This blog will explain everything, including how it works, the eligibility criteria, processing fees, and how to apply online.

What is NIC ASIA Instabuy?

NIC ASIA Instabuy is an exclusive service for NIC ASIA credit cardholders, enabling them to convert their purchases into convenient monthly EMIs. This feature allows you to manage your finances more effectively while enjoying your purchases without the burden of paying the entire amount upfront.

One of its key advantages is its fully online process. You can easily apply for this service through the NIC ASIA website or directly via this link, making it both time-efficient and hassle-free.

Why Choose Instabuy?

Benefits:

- Flexibility: Pay in small amounts over time, making it easier to manage your budgets.

- Convenience: Apply online without visiting the bank.

- Financial Planning: Perfect for managing credit card payments smartly

Eligibility and Convenience

Eligible Customers

This service is exclusively available to NIC ASIA credit cardholders.

Eligibility Criteria

- All the successful payments are eligible to be converted to EMI upon request from the cardholder -the minimum amount of purchase to be converted into EMI is Rs. 5000 and maximum up to 100% of your credit card limit or purchase amount.

- Flexible tenure options ranging from 3 months to 18months are available, so you can pick what suits you best.

- A maximum of 3 consecutive instabuy requests are permitted.

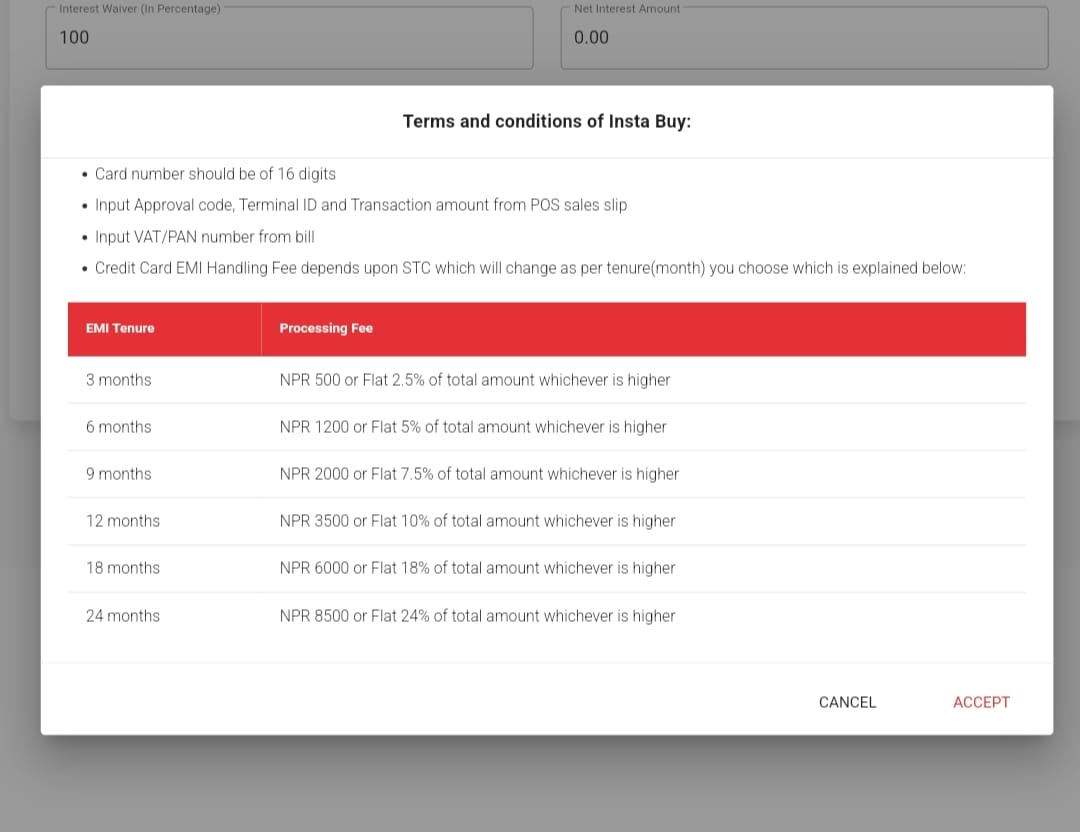

How Much Does It Cost?

NIC ASIA Instabuy is transparent about its fees. Here’s a detailed breakdown of the processing fees based on tenure:

| EMI Tenure | Processing Fee |

| 3 months | NPR 500 or Flat 2.5% of the total amount (whichever is higher) |

| 6 months | NPR 1,200 or Flat 5% of the total amount (whichever is higher) |

| 9 months | NPR 2,000 or Flat 7.5% of the total amount (whichever is higher) |

| 12 months | NPR 3,500 or Flat 10% of the total amount (whichever is higher) |

| 18 months | NPR 6,000 or Flat 18% of the total amount(whichever is higher) |

How to Apply for NIC ASIA Instabuy?

If you are willing to convert your purchase into EMI, you may request for conversion of EMI by filling up an online InstaBuy Application form. InstaBuy allows you to buy any product of your choice from merchant’s outlet/location from NIC ASIA credit card and convert it into EMI which is required to be paid in equal monthly installment.

All the customers having Credit Card can apply for InstaBuy by filling up an online form from the link https://instabuy.nicasiabank.com/insta-pay

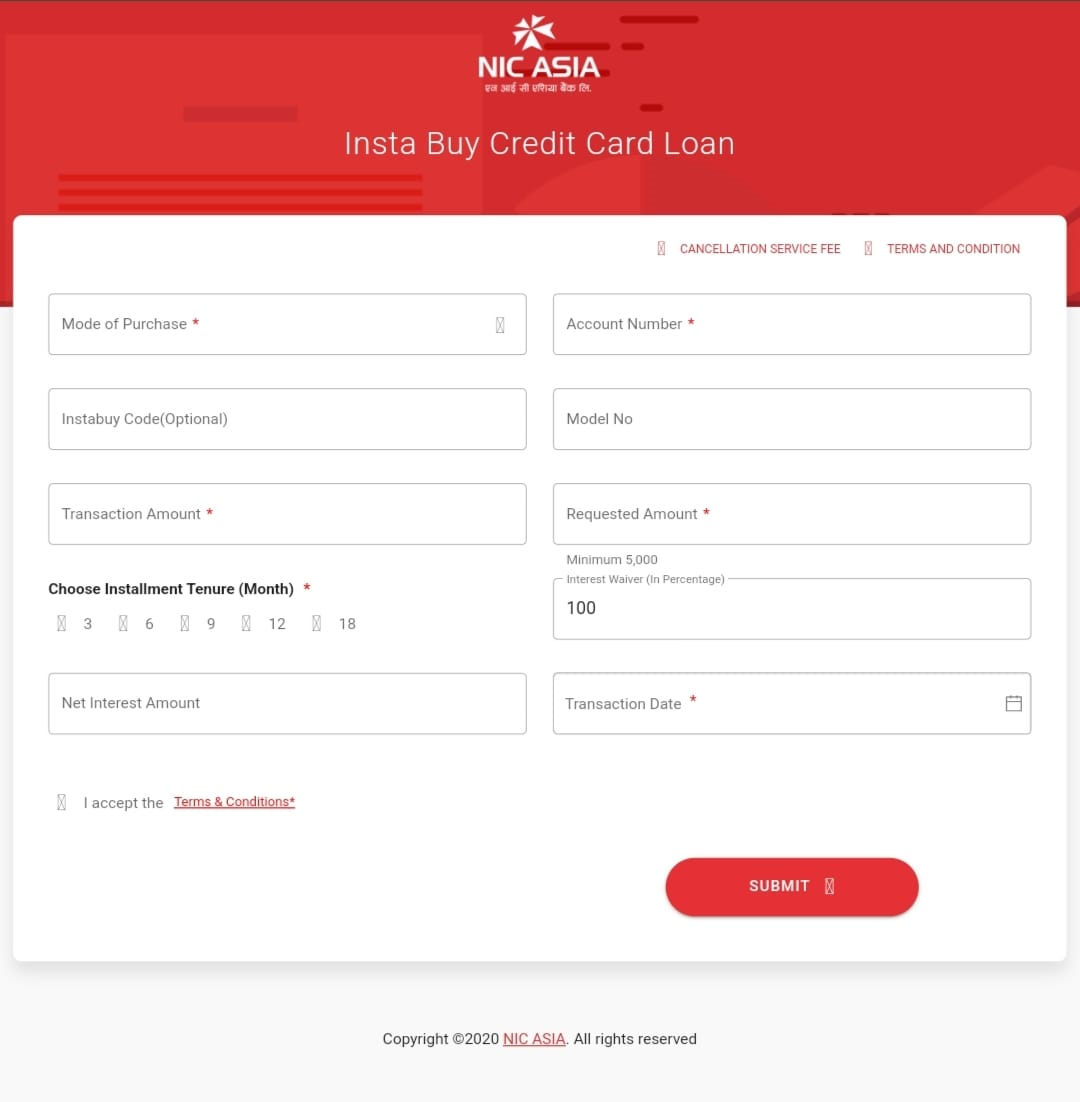

Step 1: Filling the InstaBuy online application form

– Go to the InstaBuy Application Form.

– You’ll be directed to this page where you need to enter your details.

– Enter the correct details as mentioned.

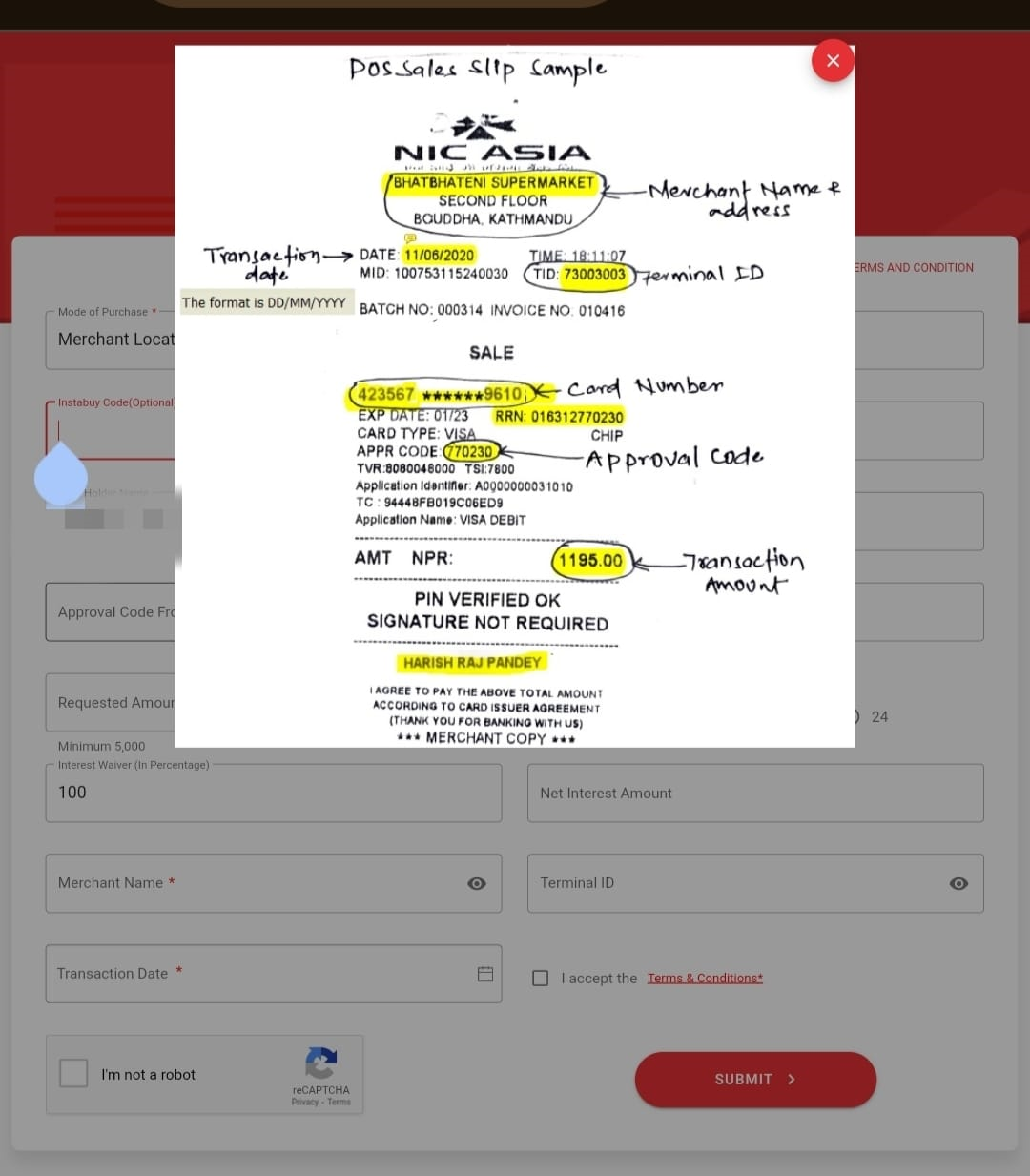

Note: “Click the eye icon to see a sample POS slip to help you enter the correct information”

Step 2: Submit Your Details

– After filling in the necessary information, agree to the terms and conditions.

– Submit the application form. The EMI handling fee will be displayed for your reference.

– Verify the CAPTCHA and hit the submit button.

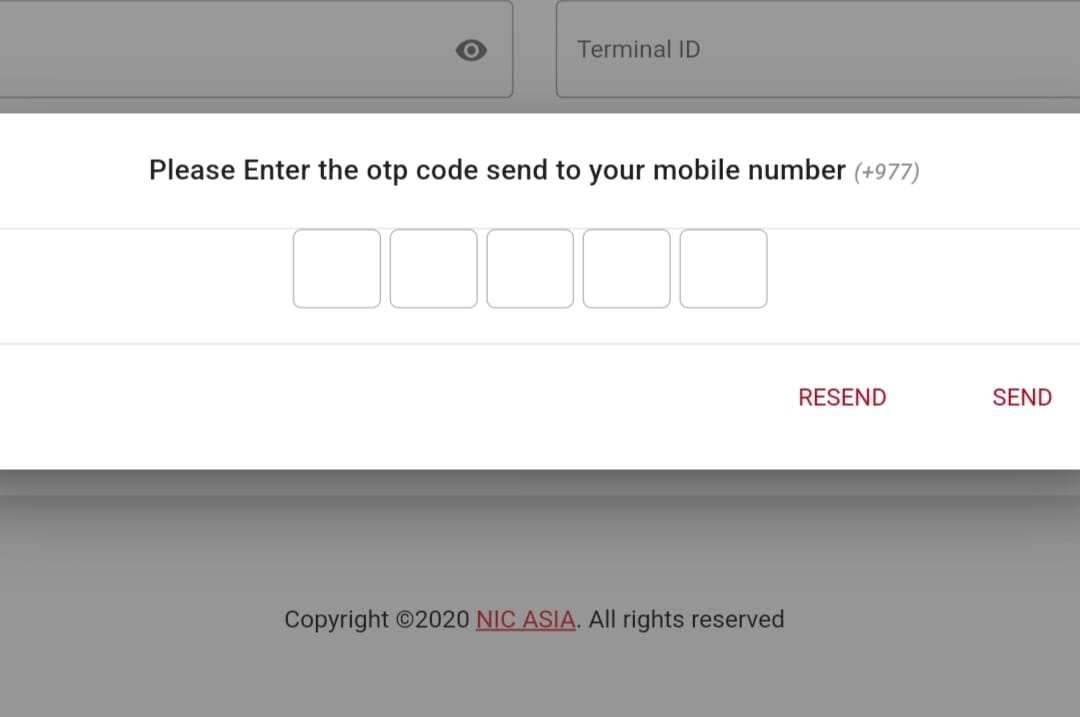

Step 3: Enter OTP for Verification

– Once submitted, an OTP (One-Time Password) will be sent to your registered mobile number.

– Enter the OTP within 2 minutes and press the “Send” button to confirm your request.

Step 4: Bank Review and Confirmation

– After submission, the bank will verify and review the details.

– If there are any errors in the application, the bank will contact you to correct them and reapply.

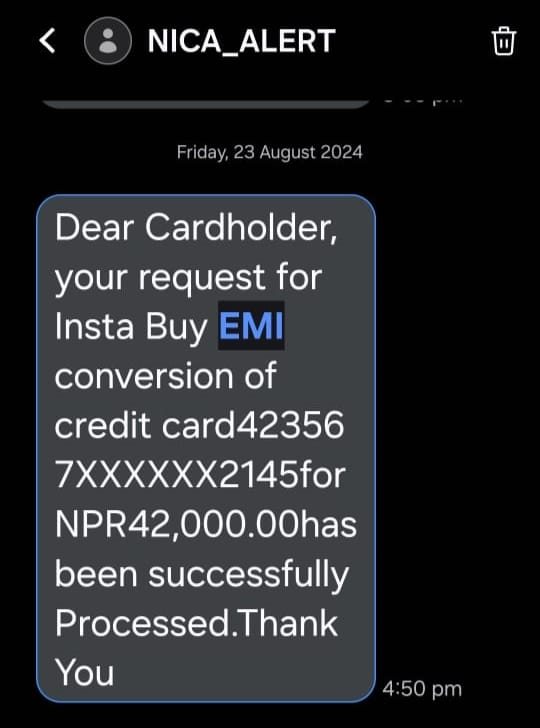

Step 4: EMI Conversion and Confirmation

– Upon successful verification, the bank will convert your purchase into EMI within 2-3 days.

– You will receive a confirmation message from the bank once the conversion is complete.

FAQs About NIC ASIA Instabuy

Q: What is NIC ASIA Instabuy?

A: NIC ASIA Instabuy is a method to pay for a purchase in installments (EMI) using a credit card.

Q: Can I convert any purchase into EMI?

A: Yes, you can convert eligible purchases made using your NIC ASIA credit card.

Q: What are the available EMI tenure options?

A: Tenure options range from minimum of 3 months to maximum of 18 months.

Q: Can I convert cash withdrawals into EMI?

A: NO, EMI options are available only for Purchase Transactions.

Q: What kind of Purchase transactions are eligible for EMI conversion?

A: Purchase transactions done on POS terminals or E-commerce Sites within Nepal and India are eligible for EMI conversion

Q: Is there a minimum or maximum purchase limit?

A: The minimum amount to convert the EMI is Rs. 5,000 whereas the maximum limit to convert into EMI is upto your credit card limit.

Q: Is there any cancellation fee for Instabuy service?

A: The Cancellation Fee is NPR 500.

Conclusion

NIC ASIA Instabuy is the perfect solution for anyone looking to manage their finances effectively. With flexible tenure options, transparent processing fees, and a simple online application, this service makes big purchases affordable and stress-free.

Take charge of your finances today! Click here to apply for NIC ASIA Instabuy and experience smarter, more convenient purchasing options.

Leave A Comment