When planning a loan, knowing your Equated Monthly Installments (EMI) is essential. NIC ASIA Bank provides an efficient EMI calculator to help you estimate your monthly payments with ease. Whether you’re considering a home loan, gold loan, or loan against share, understanding your EMI amount ensures you can manage your finances effectively.

What is an EMI?

EMI, or Equated Monthly Installment, is the fixed amount you pay to the bank every month on a specified date for your loan. It includes two components:

- Principal Amount: The actual loan amount borrowed.

- Interest Amount: The fee the bank charges you for giving you a loan.

EMIs are determined based on the loan amount, interest rate, and loan tenure. It helps you pay back the loan slowly while managing your finances.

Why Use NIC ASIA Bank’s EMI Calculator?

NIC ASIA Bank offers a user-friendly EMI calculator, accessible via this link. This tool allows you to:

- Estimate EMIs for different loan types.

- Evaluate and compare various repayment plans.

- Adjust parameters like rate of interest and tenure to find the most suitable plan.

The calculator is designed to give instant results, making it easier to plan your monthly budget. Whether you’re planning for a significant investment like purchasing a home or a small personal loan, the EMI calculator makes choosing easier.

How to Use the EMI Calculator?

Using the calculator is easy:

- Enter Loan Amount: Specify the amount you wish to borrow.

- Set the Interest Rate: Input the applicable interest rates.

- Select the Loan Tenure: Specify the duration for loan repayment, either in months or years.

The calculator will then show your EMI, including a breakdown of the principal and interest. This level of transparency ensures you have a clear understanding of the repayment process.

Example Scenarios

Home Loan EMI Calculation

Suppose you’re applying for a home loan of NPR 5,000,000 at an annual interest rate of 10% for 20 years. Using NIC ASIA Bank’s home loan EMI calculator, you can:

- Enter the loan amount (NPR 5,000,000).

- Specify the interest rate, such as 10%.

- Select a repayment tenure of 240 months (20 years).

The result will show your monthly EMI and the total repayment amount over 20 years. This insight helps you assess whether the repayment plan fits your financial capacity.

Gold Loan EMI Calculation

If you take a gold loan of NPR 300,000 at an annual interest rate of 9% for 2 years, the EMI calculator will:

- Display your monthly repayment amount.

- Show the total interest payable over the loan period.

Gold loans are secured loans, and this tool ensures you plan your finances effectively based on the loan’s flexibility and lower interest rates.

Loan Against Share EMI Calculation

For a loan against shares of NPR 1,000,000 at 11% for 1 year, the calculator helps with:

- Calculating the monthly EMI.

- Highlighting the total repayment amount.

This insight ensures that you can make informed decisions about leveraging your investments without straining your finances.

Benefits of NIC ASIA’s EMI Calculator

- Transparency: Clear breakdown of repayment details.

- Convenience: Provides instant results to support informed decision-making.

- Flexibility: Adjust parameters to evaluate multiple scenarios.

- Accuracy: Eliminates manual calculations, ensuring precision.

- Accessibility: Available online, allowing you to use it anytime, anywhere.

Factors Influencing Your EMI

Several factors can affect your EMI:

- Loan Amount: Higher amounts lead to higher EMIs.

- Interest Rate: A lower rate of interest reduces your EMI.

- Loan Tenure: Extending the tenure decreases monthly payments but increases the total interest paid.

Understanding these factors ensures you make decisions that suit your financial circumstances.

How EMI Is Calculated?

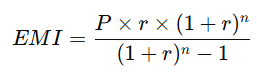

The EMI formula is as follows:

Where:

– P is the principal amount.

– r refers to the monthly interest rate, obtained by dividing the annual interest rate by 12.

– n represents the number of monthly installments, corresponding to the loan tenure in months.

NIC ASIA Bank’s EMI calculator automatically applies this formula, saving you time and effort.

Tips to Manage Your Loan Effectively

- Evaluate Your Needs: Borrow only the amount you truly need.

- Choose the Right Tenure: Balance between a comfortable EMI and total interest paid.

- Compare Interest Rates: Research and evaluate competitive rates.

- Use the EMI Calculator: Test various scenarios to find the best plan.

- Plan for Contingencies: Ensure you have a buffer for unexpected financial challenges.

NIC ASIA Bank’s Loan Offerings

NIC ASIA Bank provides a variety of loans:

- Home Loans: For purchasing or building a house.

- Gold Loans: To finance the purchase of new gold items.

- Loan Against Share: To secure funds by pledging shares as collateral.

Each loan comes with competitive interest rates and flexible repayment options. NIC ASIA Bank ensures a smooth borrowing experience, with clear terms and conditions to avoid any confusion.

Frequently Asked Questions(FAQs) About EMI

Q: Can I prepay my loan to reduce EMIs?

A: Yes, most loans allow prepayment. This reduces the outstanding principal, thereby lowering your EMIs or shortening the loan tenure.

Q: What happens if I miss an EMI payment?

A: Missing an EMI can lead to penalties and impact your credit score. Always ensure timely payments to maintain a good financial record.

Q: Can I modify the loan tenure after starting the repayment?

A: This depends on the loan agreement. Contact NIC ASIA Bank for specific terms and conditions.

Conclusion

Understanding your EMI is important for managing your finances, and NIC ASIA Bank’s EMI calculator makes it simple and easy. By providing accurate calculations of your monthly payment, the tool helps you to make better decisions about your loans. Whether it’s a home loan, car loan, or personal loan, using the calculator ensures that your monthly payments fit your financial goals.

Explore NIC ASIA’s calculator today and start planning your finances smartly. With proper planning and the right tools, achieving your financial goals becomes much easier.

Leave A Comment